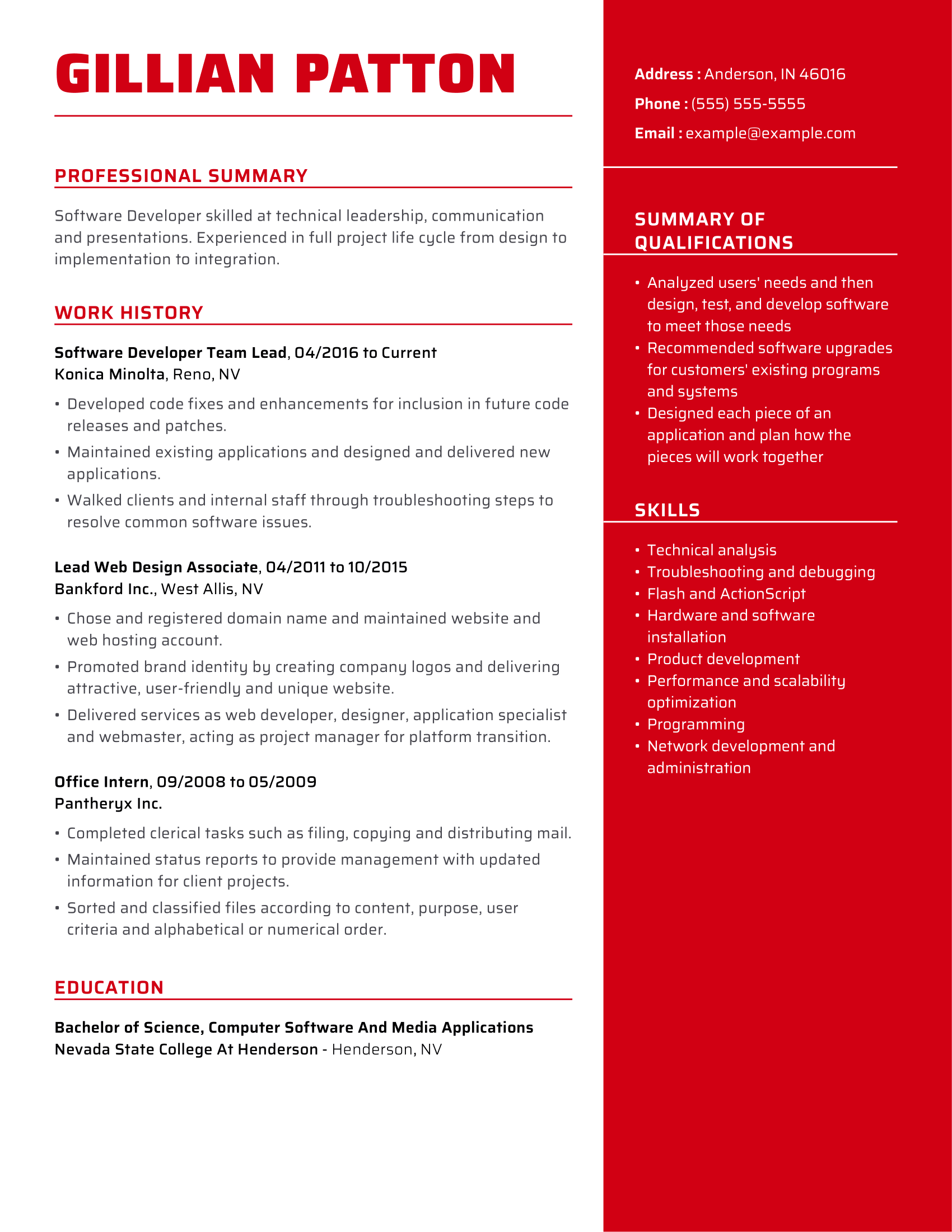

Table of Content

Reverse mortgages let you take out loans against the value of your home, but you need to have a good amount of equity to use this option. While the loan should be covered by the sale of the home, it takes away from any planned inheritance. Nursing home costs generally depend on the length of the resident’s stay, the services provided and the type of facility in question. The table below outlines the average costs of nursing home stays for older Americans, according to Genworth’s 2020 Cost of Care Survey. Medicaid coverage of non-medical home care varies from state to state.

Mom has a chronic medical condition and recently recovered from COVID-19. Her doctor recommends home health care for therapy and monitoring purposes while she fully recovers. Federal employees, members of the uniformed services, retirees, their spouses, and other qualified relatives may be able to buy long-term care insurance at discounted group rates.

Does the VA Pay for Nursing Home Care?

In-home care costs differ for non-medical in-home care and home health care. According to Genworth Financial, the average hourly cost of standard in-home care is $25, and home health care costs an average of $26. Though the difference may seem small, it adds up when someone needs frequent or around-the-clock in-home care.

The exact amount of the Medicaid applicant’s allowable income is determined by the specific state’s Medicaid program, but it is usually only $350 to $750 after regular medical expenses are deducted. Single person — State Medicaid programs limit the income of an unmarried nursing home resident in two different ways. One way, used by some state Medicaid programs, establishes a monthly income eligibility limit. This limit varies by state but generally sits at about $2,313 per month. If a Medicaid applicant has income higher than the Medicaid limit in one of these states, that person isn’t eligible for Medicaid coverage of nursing home care. At the other end of the nursing home spectrum is high-level inpatient medical care, referred to as skilled nursing or rehabilitation care.

Tips on Extended Care

SmartAsset’s free tool matches you with up to three vetted financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. When a senior leaves their old living space empty, renting it out with careful management could be a valuable income source. Turning a home into a rental might become a permanent source of income for the family or just a temporary source of income until the home is sold. Ideally, any rental arrangement will be made when the homeowner is still a competent decision-maker. For a loved one to take over, that person will need legal guardianship or power of attorney over the homeowner.

Often, this program covers 100 percent of these costs, but there may be copayments for certain beneficiaries. For those who qualify for Medicaid, this is the best choice for nursing care coverage. It's common to pay for nursing home care privately at first, then move to Medicare or another funding source later. With Medicare and other taxpayer-subsidized programs, seniors have fewer choices because nursing homes can limit the number of publicly-funded enrollees.

Respite care

The catch with this is that you must be admitted to the skilled nursing home facility within 30 days of leaving the hospital. Additionally, the reason for needing a nursing home stay must relate to the reason you were in the hospital. It’s important to note that long-term care insurance is not an investment like life insurance and it’s a use-or-lose type of coverage. There is not a single nursing home that is perfect for every person. Each patient has their own needs, health concerns and goals they work toward.

Other states have no income limit but instead require the beneficiary to pay almost all income to the nursing home, with Medicaid paying the balance of the nursing home’s charges. In these states, the Medicaid program allows the resident to keep only a small amount — about $50 to $100 per month — for personal needs. Medicare nursing home coverage is a standard part of Medicare Part A. Anyone enrolled in Medicare Part A can receive Medicare nursing home coverage if they qualify for it.

If you’re insured with a spouse, though, you’re likely to get a discount. For a 55-year-old couple, the average cost of this type of insurance is about $2,100 annually. For a 65-year-old couple, the average for a combined premium is $3,700 per year. In these situations, it may be necessary to seek out alternative options.

Even though you can use this benefit to help with nursing home costs, it may not be enough. The average Social Security check is about $1,461 a month, which is nowhere near the average monthly cost of nursing home facilities. Genworth’s Cost of Care Survey reveals that in the United States, a private room in a nursing home costs an average of $8,121 a month. Various factors impact how much a nursing home stay costs including location, size, length of stay and services offered. According to the Center for Disease Control’s most recent statistics, 1.4 million seniors lived in nursing homes in 2014 with 15,600 nursing homes in operation.

The cost depends on factors like the availability of professionals to provide the necessary care and of companies to manage the care. And, of course, cost of living greatly impacts both caretakers’ wages and the overall costs a person can expect to pay for care. Costs for nursing homes are not covered for unlimited amounts of time.

Home health aides are another option; aides are trained to provide more extensive care, while also serving as companions. Savings and private payYou can also pay for a nursing home stay out of pocket without any type of assistance, but the expense is significant. If you have enough money, you can even pay in advance without having to worry about monthly costs.Cashing out savings or retirement accounts helps cover nursing home costs. Just make sure you understand all of your options and what it means for your bottom line. Prospective nursing home residents need to be signed up for VA health care to be eligible for coverage. VA benefits can be used to stay in non-VA nursing homes, VA nursing homes and state veterans homes.

Simply enter your zip code to see all of the benefit programs in your area, including but not limited to paying for health care and medications. The federal government requires Medicaid to cover home health services for its beneficiaries in every state. Your “functional need” for home health care will need to be verified by a doctor, and there are time limits- 24/7 care is not covered. A financial advisors may be able to help you find long-term care options.

So for example, as of 20 September 2021 the single basic Age Pension is $882.20 per fortnight. 85 percent of this is $749.90 per fortnight or $53.55 per day as the maximum daily fee. When it comes to the cost of long-term insurance, it costs approximately $3,400 a year, which comes out to $283 a month.